1. SBI Simply Click Credit Card – An entry level credit card designed for internet purchases

WHY SHOULD YOU APPLY FOR SBI SIMPLY CLICK CREDIT CARD

Get Amazon Gift Card worth Rs 500 on payment of Annual Fee as a Welcome Gift from SBI Bank

Earn 10X Reward Points on online spends with exclusive partners like Apollo 24×7, BookMyShow, Cleartrip, Dominos, Eazydiner, Myntra, Netmeds & Yatra

Earn 5X Reward Points on all other online spends

OTHER AMAZING OFFERS

e-Vouchers worth Rs 2,000 each on reaching annual online spends of 1 Lakh and 2 Lakh respectively

1% fuel surcharge waiver for each transaction between Rs 500 & Rs 3000

Annual fee waiver on yearly spends above Rs 1 Lakh

ELIGIBILITY CRITERIA

Employment status: Salaried or Self-Employed

Income: Rs 30,000 per month and above

Required Age: 23-60 years

Credit Score – 650+

New to credit – Only for Salaried

Credit Card holders are preferred

No delay payments in last 12 months

Card Holders should be an Indian Citizens or a Non Resident Indian

DOCUMENTS NEEDED

ID proof

Address proof

Income proof

PAN Card/Form 60

FEES AND LIST OF ALL CHARGES

Joining Fees: Rs 499+GST

Annual Fees: Rs 499+GST Second year onwards

2.Unlock a wide range of benefits with the Swiggy HDFC Credit Card

WHY SHOULD YOU APPLY FOR SWIGGY HDFC BANK CREDIT CARD

Get 10% Cashback on Swiggy (Instamart, Food delivery, Genie & Dine out) capped at Rs 1500/month

5% Cashback on Online Shopping Spends on Amazon, Flipkart, Myntra, Nykaa etc – capped at Rs 1500/month

1% Cashback on all other categories – capped at Rs 500/month

Free Swiggy One Membership for 3 months as welcome benefit

Upto 50 days of interest-free period on your Swiggy HDFC Bank Credit Card from the date of purchase

Get zero lost card liability waivers on fraudulent transactions and Credit Card loss, upon prompt reporting

ELIGIBILITY CRITERIA

Required Age: 21-65 years

Employment status: Salaried or Self-Employed

Minimum Income: Rs 25,000 per month (Salaried)

Minimum ITR: Rs 6,00,000 per annum (Self-Employed)

Cibil- 750+

New to Credit allowed for Salaried & Self-Employed both

DOCUMENTS NEEDED

ID Proof: PAN Card/Form 60

Address Proof: Aadhaar, Passport, or utility bills

Income Proof: Bank statements or salary slips

Photograph: Recent passport-sized photo

FEES & LIST OF ALL CHARGES

Lifetime FREE Credit Card

Joining Fees: Nil

Annual Fee: Nil

3. Axis MyZone Credit Card – Entry level card offering benefits across Shopping, Dining and Entertainment

FEATURES OF THE CARD

Upto Rs 1000 Off on AJIO on minimum spends of Rs 2999 on select styles

4 Complimentary Lounge access on select domestic airports (1 per quarter)

4 EDGE REWARDS points per Rs 200 spent (Not Applicable on fuel, movie, Insurance, Wallet, Rent, Utilities, Education, Government Institutions and EMI transactions)

Dining delights offering Upto 15% Off at partner restaurants in India (Max Discount Rs 500)

1% Fuel Surcharge waiver at all petrol pumps across the country for spends between Rs 400 to Rs 4000

FEES AND LIST OF ALL CHARGES

Joining Fees: Rs 500

Annual Fees: Rs 500

DOCUMENTS NEEDED

PAN Card/Form 60

Colour photograph

Address proof

ID Proof

Income proof

ELIGIBILITY CRITERIA

Employment status: Salaried or Self-Employed

Income: Rs 15,000 per month (Salaried), Rs 30,000 per month (self-employed)

New to Credit not allowed

Cibil Score: 730 and above

Required Age: 21-65 years

4. IDFC FIRST Credit Card – 300+ Merchant offers & dining discounts all year long

WHY SHOULD YOU APPLY FOR IDFC FIRST CREDIT CARD

Lifetime FREE – No joining or Annual Fee

Reward Points NEVER Expire – Unique Feature

No interest on ATM withdrawals till 48 days

Great partner offers on stores like Myntra, Flipkart, Ajio and more

OTHER AMAZING OFFERS

Upto 10X Reward Points on your spending (value back of upto 2%)

Rs 500 Gift Voucher on spending Rs 15,000 in the first 90 days

25% Discount on Movie tickets (upto Rs 100) on Paytm App

Complimentary roadside assistance worth Rs 1,399

4 Complimentary Railway Lounge visits per quarter

4 Complimentary Domestic Airport Lounge visits per quarter on IDFC FIRST Select Credit Card on monthly spends over Rs 5000

Fuel surcharge waiver of 1% (Upto Rs 200/month)

PARTNER DISCOUNTS

10% Instant discount on Flipkart

10% Instant discount on Myntra, AJIO, Tata CliQ , 1MG

15% Instant discount on Tata CliQ Palette, Sugar cosmetics, Zomato

10-20% Instant discounts on Travel bookings on Yatra, Adani one, MMT, GoIbibo etc.

See all offers here: https://idfcfirstrewards.poshvine.com/offers

FEES AND LIST OF CHARGES

Joining Fees: Nil

Annual Fees: Nil

DOCUMENTS NEEDED

PAN Card/Form 60

Income Proof

Colour photograph

ID Proof

Income proof

ELIGIBILITY CRITERIA

Employment Status: Salaried or Self-Employed

Income group: Rs 25,000 per month

Required Age: 21-60 years (Salaried), 25-60 years (Self employed)

Minimum Cibil Score Required: 750+

5. HSBC Live Plus Credit Card – One of the best cashback credit cards

WHY SHOULD YOU APPLY FOR HSBC LIVE PLUS CREDIT CARD

Get 10% accelerated cashback on all dining, food delivery and grocery spends (capped upto Rs 1,000 per billing cycle)

4 complimentary domestic lounge visits per year (1 per quarter)

1.5% unlimited cashback on all other spends

Spend Rs.20,000 within the first 30 days of card activation and get Rs 1000 cashback

Exclusive monthly offers on Amazon, Amazon pay, Blinkit, Easydinner, Pharmeasy, etc.

ELIGIBILITY CRITERIA

Age: 21 to 65 years

Employment: Only Salaried

Salaried: Minimum monthly income of Rs 35,000

Cibil Score – 750+

You must reside in Chennai, Gurgaon, Delhi National Capital Region (NCR), Pune, Noida, Hyderabad, Mumbai, Bangalore, Kochi, Coimbatore, Jaipur, Chandigarh, Ahmedabad or Kolkata

DOCUMENTS NEEDED

ID Proof: PAN Card/Form 60/Passport

Address Proof: Aadhaar, Passport, or utility bills

Income Proof: Bank statements or salary slips

Photograph: Recent passport-sized photo

FEES & LIST OF CHARGES

Joining Fees: Rs 999 + GST

Annual Fees: Rs 999 + GST

Annual Fees will be waived on annual spends of 3,50,000 or more in a year

6. HSBC Platinum Credit Card – Lifetime FREE Credit Card – No Joining/Annual Fee

WHY SHOULD YOU APPLY FOR HSBC PLATINUM CREDIT CARD

Lifetime FREE Credit Card – No Joining/Annual Fee

Earn 2 Reward points for every Rs 150 spent (Refer to Reward redemption Heads)

Unlock 5X Reward points (10 Reward points) per Rs 150 spent on any purchases exceeding Rs 4,00,000 annually, subject to a maximum cap of 15,000 accelerated reward points per year

Redeem your Reward points for Air miles on InterMiles, British Airways and Singapore Airlines (2 Reward points = 1 Air Mile/Intermile)

Make transactions of a minimum of Rs 5000 within the first 30 days and receive a complimentary Amazon voucher worth Rs 500

Buy 1 Get 1 FREE offer on BookMyShow mobile App (maximum price of the free ticket – Rs 250) – valid only on bookings made on Saturday

OTHER AMAZING OFFERS –

Get an instant discount of upto Rs 500 on Amazon across all categories, excluding groceries, exclusively for EMI transactions

Enjoy upto 15% off on EazyDiner, with savings of upto Rs 500, when you spend a minimum of Rs 2500

Get upto 15% off on MakeMyTrip for both domestic and international bookings, valid once per card per month on Fridays, Saturdays and Sundays

Save upto Rs 5,000 at Croma stores & Croma online using your HSBC Credit Card (valid once per card per month on Saturdays & Sundays)

Benefit from a fuel surcharge waiver and save upto Rs 3,000 annually on fuel charges

REWARD POINTS REDEMPTION & VALUE

Reward points can be redeemed against Gift Vouchers and Airline Miles by the Primary Cardholder only

Reward points can be redeemed against Gift vouchers from brands like Amazon, Flipkart, Tanishq, Apple Imagine, Myntra, ShoppersStop & more

1 Reward point redemption value may vary between Rs 0.2-Rs 0.35 per point depending upon the gift voucher selected by the user

For more details on redemption value please refer to HSBC Website – https://www.hsbc.co.in/credit-cards/rewards/

ELIGIBILITY CRITERIA

Employment status: Salaried

Rs 4,00,000 per annum (for salaried individuals)

Required Age: 18-65 years

You must reside in any of the following cities: Bangalore, Chennai, Gurgaon, Hyderabad, Mumbai, New Delhi, Noida, Pune, Chandigarh, Kolkata, Jaipur, Ahmedabad, Coimbatore, Kochi

DOCUMENTS NEEDED

Address Proof

ID proof

Income proof

PAN Card/Form 60

FEES & LIST OF CHARGES

Joining Fees: Nil

Annual Fees: Nil

7. SBI Cashback Credit Card – Welcome to the World of Amazing Cashback

WHY SHOULD YOU APPLY FOR SBI CASHBACK CARD

You can apply for up to 3 Add-on cards at no additional cost against every primary card

5% Cashback on Online spends (capped at Rs 5000 per month combined for both Online & Offline spends)

1% Cashback on Offline Spends

1% Fuel Surcharge waiver up to Rs.100 per statement cycle applicable on transactions between Rs 500 to Rs 3000

ELIGIBILITY CRITERIA

Employment status: Salaried or Self-Employed

Income: Rs 30,000 per month

Required Age: 21-65 years

Credit Score – 650+

New to credit – Only for Salaried

No delay payments in last 12 months

DOCUMENTS NEEDED

ID Proof: PAN Card/Form 60

Address Proof: Aadhaar, Passport, or utility bills

Income Proof: Bank statements or salary slips

Photograph: Recent passport-sized photo

FEES AND LIST OF CHARGES

Joining Fees: Rs 999 + GST

Annual Fees: Rs 999 + GST – Second year onwards

Annual Fees will be waived on annual spends of Rs 2 Lacs

8. HDFC Shoppers Stop Credit Card

WHY SHOULD YOU APPLY FOR HDFC SHOPPERS STOP CREDIT CARD

Welcome benefit Shoppers Stop voucher of Rs. 500, redeemable on any bill value

Complimentary First Citizen Silver Edge membership worth Rs 350

Earn 3% Reward points on every SS Spends & 1 % Reward Points on Non- SS Spends (Maximum capping of Rs.500 per month on Shoppers Stop spends & Rs. 1000 per month for non-shoppers stop spends)

Get Rs 2500 worth FREE shopping in a year Earn Rs 500 per month for a minimum purchase of Rs 15,000 on Shoppers Stop over the weekend (capped to maximum once in a month and 5 times in a year)

Link your Rupay Credit card with UPI and avail ‘Scan n Pay’

OTHER AMAZING OFFERS

Bank Reward pts redemption value will be Re 1 against 1 RP when availed against Shoppers Stop voucher

FEES AND LIST OF CHARGES

Joining Fees: Rs 299

Annual Fees: Rs 299

ELIGIBILITY CRITERIA

Age group: 21-65 years

Employment status: Salaried or Self-Employed

Minimum Income: Rs 20,000 per month (Salaried)

Minimum Income: Rs 50,000 per month (Self-Employed)

Credit score: 700+

You should be citizen of India or a Non-Resident Indian

DOCUMENTS NEEDED

Address Proof – Aadhaar, Passport, Latest utility bills

ID proof – PAN, Voter ID, Passport

Income proof – Bank Statement, Salary Slips

9. SBI BPCL Credit Card – Best Card for fuel

WHY SHOULD YOU APPLY FOR SBI BPCL CREDIT CARD

2,000 Activation Bonus Reward Points worth Rs 500 on payment of joining fee

4.25% Valueback – 13X Reward Points on fuel purchases at BPCL petrol pumps

3.25% + 1% Fuel surcharge waiver on every BPCL transaction Upto Rs 400

5X Reward Points on every Rs 100 spent at Groceries, Departmental Stores, Movies & Dining

Get 1 Reward Point for every Rs 100 spent on non-fuel retail purchases

10% Instant Discount with SBI Card during Big E-commerce Sales

ELIGIBILITY CRITERIA

Required Age: 23-60 years

Employment status: Salaried or Self-Employed

Minimum Income: Rs 30,000 & Above per month

Credit Score: 650+

New to credit – Only for Salaried

Credit Card holders are preferred

No delay payments in last 12 months

Card Holders should be an Indian Citizens or a Non Resident Indian

DOCUMENTS NEEDED

ID proof

Address proof

Income Proof

Valid PAN Card/Form 60

FEES AND LIST OF CHARGES

Joining Fees: Rs 499 + GST

Annual Fees: Rs 499 + GST from second year onwards

10. SBI Miles Credit Card – Get 1,500 Travel Credits as Welcome Gift

WHY SHOULD YOUR FRIENDS & FAMILY APPLY FOR SBI MILES CREDIT CARD

Get 1500 Travel Credits as a Welcome Gift on spends of Rs 30,000 within 60 days of card issuance

Earn 2 Travel Credits for every Rs 200 spent on travel and Earn 1 Travel Credit for every Rs 200 on all other spends

Redeem your Travel Credits for Air Miles, Hotel Points, Travel Bookings, or choose from a variety of exciting catalogue products

Get an additional Domestic Lounge Access for every Rs 1 lakh spent

Earn 5000 Bonus Travel Credits on annual spends of Rs 5 lakhs

Get your Annual Fee waived by spending Rs 6 Lakh in a membership year

Enjoy a low 3.0% Foreign Currency Mark-up on International transactions

Get 1% Fuel Surcharge Waiver at all petrol pumps, maximum surcharge waiver of Rs 250 per month, per statement cycle

Complimentary Priority Pass Program for the first 2 years

ELIGIBILITY CRITERIA

Age: 21 to 65 years

Employment Status: Salaried or Self-Employed

Income (Salaried): Rs 60,000

Self-Employed: Rs.7,20,000 lakhs

Credit Score: Minimum credit score of 750+ with no delayed payments in the past 12 months

New to Credit: Not Allowed

DOCUMENTS NEEDED

ID Proof: PAN Card/Form 60

Address Proof: Aadhaar, Passport, or utility bills

Income Proof: Bank statements or salary slips

Photograph: Recent passport-sized photo

FEES AND LIST OF CHARGES

Annual Fee (one-time): Rs 1499 + GST

Renewal Fee (per annum): Rs 1499 + GST

However, fee is reversed if annual spends in the membership year >= Rs 6,00,000

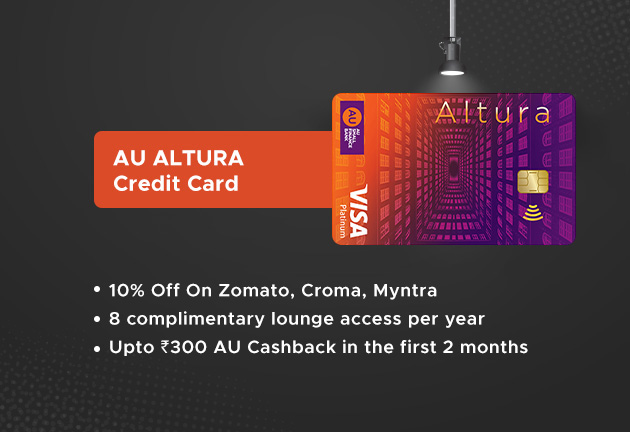

11. AU Altura Credit Card – Earn reward points every time you spend

FEATURES OF THE CARD

2% Cashback on all retail spends done at Grocery stores, Departmental stores and Utility bill payments (Maximum cashback per statement cycle is Rs 50)

1% Cashback on all other retail spends (Maximum cashback per statement cycle is Rs 50)

Get additional cashback of Rs 50 on completing a minimum of Rs 10,000 retail spends in every statement cycle

2 complimentary lounge access per calendar quarter, using VISA Card at railway stations in New Delhi, Kolkata (Sealdah), Jaipur, Ahmedabad and Agra

1% Fuel Surcharge Waiver for fuel transactions done between Rs 400 and Rs 5,000 across all fuel stations in the country

Convert your transactions worth INR 2,000 or more into easy EMI options on selected tenure of your choice

PARTNER DISCOUNTS

10% Instant Discount upto Rs 1,000 per month on Flipkart Orders Above Rs 10,000

Additional 10% Off upto Rs 1000 on Myntra

10% off on Swiggy Instamart (Upto Rs 100 per month) on Orders Above Rs 500

15% instant discount upto Rs 300 per month on Tata CLiQ Orders Above Rs 500

Flat Rs 100 off on Groceries upto Rs 100 on Blinkit app orders above Rs 1000

FEES & LIST OF ALL CHARGES

Joining Fees: Rs 199 + applicable taxes (Joining fees will be waived off, if the user spends Rs 10,000 within first 90 days of card issuance)

Annual Fees: Rs 199 + applicable taxes (Annual fees will be waived off, if the user spends Rs 40,000 within the first anniversary year)

ELIGIBILITY CRITERIA

Required Age: 21-60 years

Employment status: Salaried or Self-Employed

Income: Rs 25,000 per month (Salaried and Self-employed)

Customers need to have an Existing card (6 months old) with a minimum limit of Rs 30,000

No Delayed Payments in the last 12 months

Required Credit Score: 700+

DOCUMENTS NEEDED

Valid PAN Card

Aadhar Card – should be linked to Mobile (For EKYC)

Address proof

Income Proof (if opted for Income surrogate)

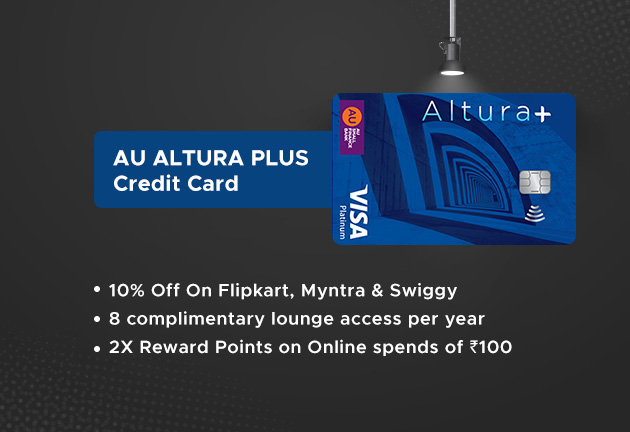

12. AU Altura Plus Credit Card – Enjoy the limitless spending and wide variety of benefits

FEATURES OF THE CARD

1.5% Cashback on all POS retail spends done (Except Fuel) at merchant outlets (Maximum cashback per statement cycle is Rs 100) 2X Reward Points (i.e., 2 Reward Points per Rs 100 retail spends) for all your online transactions

2 complimentary lounge access per calendar quarter, using VISA Card at railway stations in these cities – New Delhi, Kolkata (Sealdah), Jaipur, Ahmedabad and Agra

1% Fuel Surcharge Waiver for fuel transactions done between Rs 400 and Rs 5,000 across all fuel stations in the country

Convert your transactions worth INR 2,000 or more into easy EMI options on selected tenure of your choice

PARTNER DISCOUNTS

5% Instant Discount on shopping at Croma (min. spend Rs 15,000) – Offer valid once per month

15% Off on EasyDiner (min spend Rs 2,500 & max discount Rs 500) – Offer valid once per month

15% Off on Tata CliQ (min spend Rs 500 & max discount Rs 300) – Offer valid once per month

15% Off on Domestic Flight & 10% Off International Flight on Cleartrip – Offer valid once per month

20% Off on Movies Tickets (min spend Rs 500 & max discount Rs 100) – Offer valid once per month

More Amazing E-Comm discount offers from 5% – 25%. Check here : https://offers.aubank.in/

FEES & LIST OF ALL CHARGES

Joining Fees: Rs 499 + applicable taxes (Joining fees will be waived off, if the user spends Rs 20,000 within first 90 days of card issuance)

Annual Fees: Rs 499 + applicable taxes (Annual fees will be waived off, if the user spends Rs 80,000 within first anniversary year)

ELIGIBILITY CRITERIA

Required Age: 21-60 years

Employment status: Salaried or Self-Employed

Income: Rs 25,000 per month (Salaried and Self-employed)

Customers need to have an Existing card (6 months old) with a minimum limit of Rs 30,000

No Delayed Payments in the last 12 months

Required Credit Score: 700+

DOCUMENTS NEEDED

Valid PAN Card

Aadhar Card – should be linked to Mobile (For EKYC)

Address proof

Income Proof (if opted for Income surrogate)

13. Axis Airtel Credit Card – Seamless Connections, Superior Rewards Await

WHY SHOULD YOU APPLY FOR AXIS AIRTEL CREDIT CARD?

Get an Amazon eVoucher worth Rs 500 on your first transaction using your Airtel Axis credit card within 30 days of card issuance

Earn 25% Cashback on Airtel Mobile, Broadband, DTH & WiFi bill Payments via Airtel Thanks app (Upto Rs 250 per month)

Earn 10% Cashback on Swiggy, Zomato & BigBasket (Upto Rs 500 Per month)

Earn 10%Cashback on Utility Bill Payments such as electricity, gas etc. via Airtel Thanks app (Upto Rs 250 per month)

Get 1% Cashback on all other spends

Enjoy 4 Complimentary lounge visits within India (4 Lounge access in a year) on minimum spends of Rs 50,000 in previous 3 months

Get 1% fuel surcharge waiver on fuel purchases at all fuel stations across India

Enjoy Upto 15% Off at partner restaurants via EazyDiner

ELIGIBILITY CRITERIA

Employment Status: Salaried or Self-employed

New to Credit not allowed

Income group: Starting from Rs 15,000 per month (Salaried), Starting from Rs 30,000 per month (self-employed)

Age group: 21-70 years

Cibil Score: 730 and above

DOCUMENTS NEEDED

PAN Card/Form 60

ID Proof

Address proof

Bank Statement or Income proof

Colour photographs

FEES AND LIST OF ALL CHARGES

Joining Fees: Rs 500 + GST

Annual Fees: Rs 500 + GST

Annual fees waived off on annual spends over Rs 2,00,000

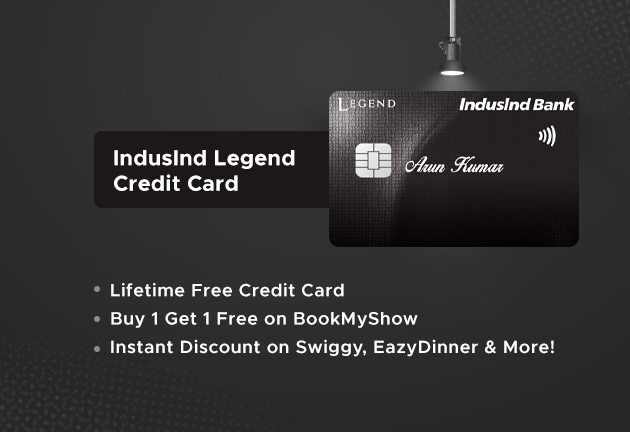

14. IndusInd Legend Credit Card – Experience the best of travel, dining and shopping

WHY SHOULD YOU APPLY FOR INDUSIND BANK LEGEND CREDIT CARD

LIFETIME FREE Card – No Joining & Annual Fees

Rs 100 spent = 1 Reward Point on weekdays spends

Rs 100 spent = 2 Reward Points on weekends spends

Buy 1 Get 1 Free on BookMyShow – 3 Free tickets every month

OTHER AMAZING OFFERS

Instant Discount on Swiggy, EazyDinner & more brands

Lowest Forex Markup Charge of 1.8%

ICICI Lombard General Travel Insurance

PARTNER DISCOUNTS

Flat 10% off sitewide on boAt products

Get 10% instant discount upto Rs 250 on minimum purchase of Rs 2000 on BigBasket

PVR: Get Rs 100 Off on purchase of Food & Beverage on Orders Above Rs 350

Lifestyle: Additional 15% Off on Lifestyle on Orders Above Rs 1999

Amazing offers on major e commerce like Swiggy, Titan, Reliance & more

ELIGIBILITY CRITERIA

New to Credit: Allowed

Employment Status: Salaried or Self-employed

Income group: Rs 80,000 for Salaried and Rs 1,00,000 for Self-Employed

Age group: 21-65 years

Credit Score: 650+

No Delayed Payments in the last 12 months

GOOD TO HAVE

Existing Home or Auto Loan

Existing active credit card with a limit of more than Rs 50,000 of any bank

DOCUMENTS NEEDED

ID Proof

Address Proof

Income Proof

PAN Card/Form 60

FEES & LIST OF ALL CHARGES

Lifetime Free Card

Joining Fees: Nil

Annual Fees: Nil

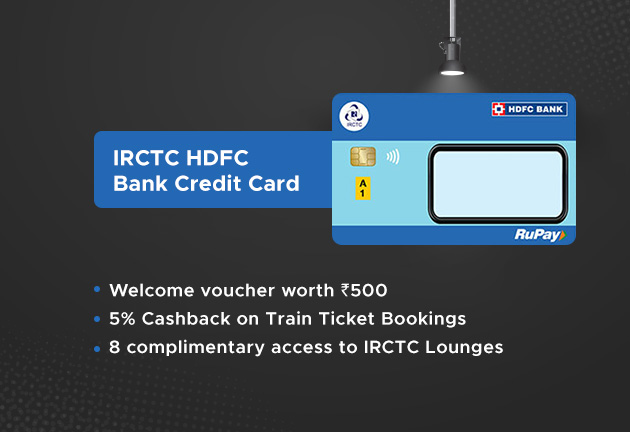

15. IRCTC Hdfc bank credit card with save while you Travel and make your journeys much more rewarding

WHY SHOULD YOUR FRIENDS & FAMILY APPLY FOR IRCTC HDFC BANK CREDIT CARD

Welcome voucher worth Rs 500 on card activation within first 37 days of Card Activation

5 Reward points for every Rs 100 spent on IRCTC ticketing website & Rail Connect App

Additional 5% Cashback on train ticket bookings via HDFC Bank SmartBuy

Credit Card to UPI – The HDFC IRCTC Credit Card can be linked to your UPI

Annual fee waiver on annual spends of Rs 1,50,000 or more

OTHER AMAZING OFFERS

8 complimentary access to select IRCTC Executive Lounges every year (2 per quarter)

1% fuel surcharge waiver at all fuel stations across India (on minimum transaction of INR 400 & maximum transaction of INR 5,000. Maximum waiver of INR 250 per statement cycle)

Upto 50 days of interest free period on your IRCTC HDFC Bank Credit Card from the date of purchase

Revolving Credit : Available at a nominal interest rate on your HDFC Bank Rupay IRCTC Credit

ELIGIBILITY CRITERIA

Age group: 21-60 years

Employment status: Salaried or Self-Employed

Minimum Income: Rs 25,000 per month (Salaried)

Minimum Income: Rs 6,00,000 per annum (Self-Employed)

DOCUMENTS NEEDED

Address Proof – Aadhaar, Passport, Latest utility bills

ID proof – PAN, Voter ID, Passport

Income proof – Bank Statement, Salary Slips

FEES & LIST OF ALL CHARGES

Joining Fees: Rs 500 + GST

Annual Fees: Rs 500 + GST

16. Axis Flipkart Credit Card – Enjoy accelerated cashback across all your favourite categories

FEATURES OF THE CARD

You can get Rs 500 Flipkart E-Gift Voucher as Welcome Benefit

Earn 5% Cashback on Flipkart, 4% Cashback on Swiggy, Uber, PVR, Cleartrip, Curefit & Tata Play & 1.5% cashback on all other categories except wallet load, EMI, Rent, Jewelry, government services etc.

4 complimentary domestic lounge visits + 1% Fuel Surcharge waiver & More

ELIGIBILITY CRITERIA

Employment status: Salaried or Self-Employed

New to Credit not allowed

Cibil Score: 730 and above

Income: Rs 15,000 per month (Salaried), Rs 30,000 per month (self-employed)

Required Age: 21-70 years

17. Hdfc Bank Millennia credit card with Enjoy Seamless Banking with Unmatched Benefits

WHY SHOULD YOU APPLY FOR HDFC BANK CREDIT CARD

Exciting discounts on online purchases across partners brands

Complimentary access to airport lounges at domestic and international airports

Get lucrative vouchers on meeting minimum monthly spending criteria

Leverage revolving credit facilities at nominal interest rates

You earn rewards on all spends that can be redeemed for exciting gifts, vouchers or free flight tickets

ELIGIBILITY CRITERIA

Age group: 21-65 years

Employment status: Salaried or Self-Employed

Minimum Income: Rs 20,000 per month (Salaried)

Minimum Income: Rs 50,000 per month (Self-Employed)

Credit Score: 700+

You should be citizen of India or a Non-Resident Indian

DOCUMENTS NEEDED

Address Proof – Aadhaar, Passport, Latest utility bills

ID proof – PAN, Voter ID, Passport

Income proof – Bank Statement, Salary Slips

FEES & LIST OF ALL CHARGES

Joining Fees: Starting at Rs 500 + GST (Depending upon the card selected)

Annual Fees: Starting at Rs 500 + GST (Depending upon the card selected)

18. Axis Indian Oil Rupay Credit Card – Credit card that offers higher rewards on your fuel transactions

FEATURES FO THE CARD

You can enjoy Accelerated rewards on fuel and other expenses

100% Cashback upto Rs 250 on all fuel spends within first 30 days of card issuance

10% instant discount on movie tickets booked via BookMyShow website

Enjoy upto 15% Discount on partner Restaurants

ELIGIBILITY CRITERIA

Employment status: Salaried or Self-Employed

New to Credit not allowed

Cibil Score: 730 and above

Income: Rs 15,000 per month (Salaried), Rs 30,000 per month (self-employed)

Required Age: 21-65 years

Available across major cities in India

FEES AND LIST OF CHARGES

Joining Fees: Rs 500 (excluding GST)

Annual Fees: Rs 500 (excluding GST)

Annual fees waiver: Rs 50,000 spends in one calendar year

Interest rate: 3.6% per month

Cash Withdrawal charges: 2.5% (Min Rs 500)

19. AU SwipeUp Platform – A platform to upgrade your existing credit card

FEATURES OF THE CARD

You can Upgrade any Existing Credit Card from any Bank to an AU Credit Card

Lifetime free credit card with no joining or annual fee

Get Higher Reward Points, Exciting Cashbacks & Increased Credit Limit

Enjoy Special Value Added Features that suit your lifestyle & spendings

ABOUT AU SWIPEUP PLATFORM CREDIT CARD –

SwipeUp Platform is a unique offering of AU Small Finance Bank that offers upgraded Credit Card to other Bank Credit Cardholders. Through this platform, you will get an assured upgraded AU Credit Card against other bank’s existing credit card matching your current upgraded lifestyle

FEES & LIST OF ALL CHARGES

Lifetime Free Card

No Joining / Renewal / Annual Fees

Only applicable for existing credit card holders of other banks

20. Axis Magnus Credit Card – India’s most rewarding credit card for travel, food and online shopping

FEATURES OF THE CARD

You can enjoy various benefits including hotel discounts, concierge services and more!

Get Complimentary luxury brand voucher worth Rs 12,500

Unlimited Complimentary Domestic and International Lounge visits

Upto 15% Off on International & Domestic stays at Oberoi & Trident Hotels

MORE FEATURES OF THE CARD

Enjoy 8 complimentary end-to-end meet & assist services at the airport

Buy one movie/non-movie ticket and get Upto Rs 500 Off on the second (5 times/month)

Upto 40% Off at over 4000 restaurants across India

Virtual health assistance including tele-consultation, specialist appointments, health coaching, etc

Special preventive healthcare packages with Dr. Lal Path Lab and Metropolis

For every Rs 200 spent, earn 12 EDGE REWARD points on monthly spends of Upto Rs 1.5 lakh

35 EDGE REWARD points per Rs 200 spent after Rs 1.5 lakh spent

Catalogue link for rewards redemption – https://edgerewards.axisbank.co.in/lms/

FEES AND LIST OF CHARGES

Joining Fees: Rs 12,500 only

Annual Fees: Rs 12,500 + Taxes

Interest rate: 2.5% per month

Annual Fee Waiver: On spending Rs 25,00,000 or more in the preceding year

DOCUMENTS NEEDED

PAN Card

Address proof (Utility Bills, Aadhar Card, Driving License, Ration card etc)

ID Proof (Aadhar card, Voter ID card, Driving License, Passport etc)

Income Proof (Salary Slip, Bank Statement, Form 16 etc)

ELIGIBILITY CRITERIA

Minimum Income: Rs 18 Lakhs per annum

New to Credit not allowed

Cibil Score: 730 and above

Required Age: 21-65 years

Available across major cities in India

21. AU SwipeUp Platform – A platform to upgrade your existing credit card

FEATURES OF THE CARD

You can Upgrade any Existing Credit Card from any Bank to an AU Credit Card

Lifetime free credit card with no joining or annual fee

Get Higher Reward Points, Exciting Cashbacks & Increased Credit Limit

Enjoy Special Value Added Features that suit your lifestyle & spendings

ABOUT AU SWIPEUP PLATFORM CREDIT CARD –

SwipeUp Platform is a unique offering of AU Small Finance Bank that offers upgraded Credit Card to other Bank Credit Cardholders. Through this platform, you will get an assured upgraded AU Credit Card against other bank’s existing credit card matching your current upgraded lifestyle

FEES & LIST OF ALL CHARGES

Lifetime Free Card

No Joining / Renewal / Annual Fees

Only applicable for existing credit card holders of other banks

22. Axis Magnus Credit Card – India’s most rewarding credit card for travel, food and online shopping

FEATURES OF THE CARD

You can enjoy various benefits including hotel discounts, concierge services and more!

Get Complimentary luxury brand voucher worth Rs 12,500

Unlimited Complimentary Domestic and International Lounge visits

Upto 15% Off on International & Domestic stays at Oberoi & Trident Hotels

MORE FEATURES OF THE CARD

Enjoy 8 complimentary end-to-end meet & assist services at the airport

Buy one movie/non-movie ticket and get Upto Rs 500 Off on the second (5 times/month)

Upto 40% Off at over 4000 restaurants across India

Virtual health assistance including tele-consultation, specialist appointments, health coaching, etc

Special preventive healthcare packages with Dr. Lal Path Lab and Metropolis

For every Rs 200 spent, earn 12 EDGE REWARD points on monthly spends of Upto Rs 1.5 lakh

35 EDGE REWARD points per Rs 200 spent after Rs 1.5 lakh spent

Catalogue link for rewards redemption – https://edgerewards.axisbank.co.in/lms/

FEES AND LIST OF CHARGES

Joining Fees: Rs 12,500 only

Annual Fees: Rs 12,500 + Taxes

Interest rate: 2.5% per month

Annual Fee Waiver: On spending Rs 25,00,000 or more in the preceding year

DOCUMENTS NEEDED

PAN Card

Address proof (Utility Bills, Aadhar Card, Driving License, Ration card etc)

ID Proof (Aadhar card, Voter ID card, Driving License, Passport etc)

Income Proof (Salary Slip, Bank Statement, Form 16 etc)

ELIGIBILITY CRITERIA

Minimum Income: Rs 18 Lakhs per annum

New to Credit not allowed

Cibil Score: 730 and above

Required Age: 21-65 years

Available across major cities in India

23. AU LIT Credit Card – Customizable credit card based on your lifestyle and usage

FEATURES OF THE CARD

You can get a LIFETIME FREE Credit Card

Customize your card according to your needs, opt for any benefit by paying a fee

Get Amazing Partner Discounts & Much more!

PARTNER DISCOUNTS

10% Instant Discount (Upto Rs 1,000) on Flipkart Orders Above Rs 10,000

Additional 10% Off (Upto Rs 1000) on a minimum purchase of Rs 3999 on selected styles on Myntra

15% instant discount (Upto Rs 300 per month) on Tata CLiQ Orders Above Rs 500

10% off on Groceries (Upto Rs 100) on Blinkit app orders above Rs 499

CUSTOMIZATION OPTIONS ON AU LIT CREDIT CARD –

Rs 49 (For 90 Days)Get 1% fuel surcharge waiver on fuel transactions Rs 99 (For 90 Days)Get complimentary 3 month Zee5 membership Rs 199 (For 90 Days)

(for each benefit)Get 1 complimentary Domestic

Airport lounge visits per quarter

Get 2% additional cashback on achieving milestone spends

Get complimentary 3 month Amazon prime membership

Get 5X Reward Points for online spends Rs 299 (For 90 Days)

(for each benefit)Get 2 complimentary Domestic airport lounge visits

Get 5% additional cashback on achieving milestone

Get 10X Reward Points for Offline

Get 5% additional cashback on all Dining

Get 5% additional cashback on all Grocery

Get 5% additional cashback on all Travel Rs 499 (For 90 Days)Get complimentary 3 month Cult. fit membership

ELIGIBILITY CRITERIA

Employment status: Salaried or Self-Employed

Income: Rs 25,000 per month (Salaried and Self-employed)

Required Age: 21-60 years

Customers need to have an Existing card (6 months old) with a minimum limit of Rs 30,000

No Delayed Payments in the last 12 months

Required Credit Score: 700+

DOCUMENTS NEEDED

Valid PAN Card

Aadhar Card – should be linked to Mobile (For EKYC)

Address proof

Income Proof (if opted for Income surrogate)

24. IndusInd Platinum Credit Card – Enjoy a range of travel, lifestyle and golf benefits to suit your preferences

WHY SHOULD YOU APPLY FOR INDUSIND PLATINUM CREDIT CARD

Lifetime Free Credit Card | No Joining or Annual Fees

Earn 1.5 Reward Points (1 Reward Point = Rs 0.65) on every Rs 150 spent

1% fuel waiver charge on all petrol pumps across India

Get complimentary ICICI Lombard Travel insurance under the Platinum Travel Plus

Complimentary personal air accident insurance cover of upto Rs 25 lakhs

PARTNER DISCOUNTS

Upto Rs 400 Off on Orders Above Rs 2000 on Ajio

Rs 100 Off on purchase of Food & Beverage on Orders Above Rs 350 on PVR

Additional 15% Off on Lifestyle on Orders Above Rs 1999

Get Upto Rs 1000 Off on Flight & Hotel bookings on EaseMyTrip

Get 15% discount (upto Rs 500) on Orders Above Rs 1500 on EazyDiner

ELIGIBILITY CRITERIA

Income group: Rs 20,000 for Salaried and Rs 30,000 for Self-Employed

Age group: 21-65 years

Credit Score: 650+

No Delayed Payments in the last 12 months

New to Credit is Allowed

Existing Home or Auto Loan

Existing active credit card with a limit of more than Rs 50,000 of any bank

DOCUMENTS NEEDED

No physicals documents required

Keep your Aadhaar and PAN number handy

Income Proof

FEES & LIST OF ALL CHARGES

Lifetime Free Card

Joining Fees: Nil

Annual Fees: Nil

Annual Fee Waiver: Not applicable

25. IndusInd Rupay Platinum Credit Card – Gives you the freedom to choose rewards that align with your preferences and lifestyle

WHY SHOULD YOU APPLY FOR INDUSIND RUAPY PLATINUM CREDIT CARD

Lifetime Free Credit Card – No Joining or Annual Fees

Massive savings on Ajio, Swiggy, PVR, Eazydiner & more. See ‘Partner Discounts’ section below

Earn 2 Reward Points (1 Reward Point = Rs 0.35) on every Rs 100 spent on UPI transactions

Earn 1 Reward Points on every Rs 100 spent on all other spends

PARTNER DISCOUNTS

Flat 10% Off sitewide on boAt products

Get 10% instant discount (Upto Rs 250) on minimum purchase of Rs 2000 on BigBasket

PVR: Get Rs 100 Off on Food & Beverage Orders over Rs 350

Lifestyle: Get Additional 15% Off on Lifestyle orders over Rs 1999

Amazing offers on Swiggy, Titan, Reliance & more

For more amazing discount offers, Check Here: https://www.indusmoments.com/offers/search

ELIGIBILITY CRITERIA

Employment Status: Salaried or Self-employed

Monthly Income: Rs 20,000 for Salaried & Rs 30,000 for Self-Employed

Age group: 21-65 years

Credit Score: 650+

No Delayed Payments in the last 12 months

New to Credit is Allowed

Existing Home or Auto Loan

Existing active credit card with a limit of more than Rs 50,000 of any bank

DOCUMENTS NEEDED

ID Proof

Address Proof

Income Proof

PAN Card

FEES & LIST OF ALL CHARGES

Lifetime Free Card

Joining Fees: Nil

Annual Fees: Nil

26. Axis Indian Oil Credit Card – Designed to benefit you on every fuel transaction

FEATURES OF THE CARD

Share this Deal & Your Friends can get 100% Cashback (upto Rs 250) on all fuel transactions in first 30 days

20 reward points per Rs 100 spent at IOCL pumps across India

1% fuel surcharge waiver

Upto 10% instant discount on movie tickets via BookMyShow

Upto 20% dining discounts at partner restaurants

ELIGIBILITY CRITERIA

Employment status: Salaried or Self-Employed

Income: Rs 15,000 per month (Salaried), Rs 30,000 per month (self-employed)

New to Credit not allowed

Required Age: 21-60 years

27. ICICI Bank Credit Card – Elevate Every Purchase with ICICI Credit Cards

WHY SHOULD YOU APPLY FOR ICICI BANK CREDIT CARD?

Lifetime FREE – Select Variants of ICICI Bank Credit Card are offered without any joining or Annual Fee

Discount on Online Sales – With ICICI Credit Card, you can avail great discount offers on Amazon/Flipkart Sales

Earn 2 Reward Points on every Rs 100 spent for all retail purchases except fuel

Get 1 Reward Point on every Rs 100 spent on utilities and insurance categories

OTHER AMAZING OFFERS

You can use ICICI Bank Credit Card to avail discounts over many websites like MakeMyTrip, Sterling Resorts, Haier, McDonalds etc.

You earn rewards on all spends that can be redeemed for exciting gifts, vouchers or free flight tickets

ELIGIBILITY CRITERIA

Age group: 21-65 years

Employment status: Salaried or Self-Employed

Minimum Income: Rs 50,000 per month (Both Salaried and Self-Employed)

Credit score: 750+

You should be citizen of India or a Non-Resident Indian

DOCUMENTS NEEDED

PAN Card

Aadhaar Card

Bank Statement

FEES AND LIST OF ALL CHARGES

Joining Fees: Lifetime Free (Depending upon the card selected)

Annual Fees: Lifetime Free (Depending upon the card selected)

28. HDFC Bank tata neu credit card

WHY SHOULD YOU APPLY FOR TATA NEU HDFC BANK CREDIT CARD

You get up to 10% savings as Tata NeuCoins for all Tata brands like BigBasket, Air Asia, Tata 1mg, Croma, TataCliQ, Westside, Titan, Tanishq, etc. Applicable for transactions done on TataNeu app/website and registering for Tata NeuPass

Up to 1.5% savings on all UPI spends via Tata Neu App using NeuCard.(maximum of Rs 500 per month)

Get 12 free airport lounge access (8 domestic + 4 International) Per annum on NeuCard Infinity. 4 Domestic lounge access on NeuCard Plus

OTHER AMAZING OFFERS

1% fuel surcharge waiver at all fuel stations across India on transaction of Rs 400 – Rs 5,000. (Max. waiver of Rs 250 / 500 per statement cycle for Plus/Infinity

Leverage revolving credit facilities at nominal interest rates

Get zero lost card liability waivers on fraudulent transactions and Credit Card loss, upon prompt reporting

FEES AND LIST OF CHARGES

Joining Fees: Free for limited time only

Annual Fees: NeuCard Infinity – Rs 1499 + Taxes

Annual Fees: NeuCard Plus – Rs 499 + Taxes

ELIGIBILITY CRITERIA

Required Age: 21 – 65 years

Employment status: Salaried or Self-Employed

Minimum Income: Rs 25,000 per month (Salaried)

Minimum Income: Rs 6 lakhs per annum (Self-Employed)

DOCUMENTS NEEDED

Address Proof – Aadhaar, Passport, Latest utility bills

ID proof – PAN, Voter ID, Passport

Income proof – Bank Statement, Salary Slips

29. IDFC FIRST WOW Credit Card – a Lifetime free credit card, Never expiring rewards

WHY SHOULD YOU APPLY FOR IDFC FIRST WOW CREDIT CARD

Lifetime Free Card – Guaranteed Approval

No Credit History / Income Proof required

Reward Points that NEVER expire

Interest free cash withdrawal from ATM up to 48 days

Get 7.5% Interest on your Fixed Deposit

Upto 20% discounts applicable on 1500+ Restaurants

OTHER AMAZING OFFERS –

50% off on BookMyShow Movie Tickets

Setup your own credit limit by fixed deposit anytime, anywhere

Great partner offers on 300+ brands like Myntra, Flipkart, Ajio, etc.

Zero Forex Conversion Fee

Personal Accident cover of up to Rs.2,00,000

Fuel surcharge waiver of 1% upto Rs. 200/month

PARTNER DISCOUNTS –

10% Instant discount on Flipkart

10% Instant discount on Myntra, AJIO, Tata CliQ,1MG

15% Instant discount on Tata CliQ, Palette, Sugar cosmetics, Zomato

10-20% Instant discounts on Travel bookings on Yatra, Adani one, MMT , GoIbibo etc

See all offers here: https://idfcfirstrewards.poshvine.com/offers

ELIGIBILITY CRITERIA

Required Age: 21-60 years (Salaried), 25-60 years (Self employed)

FEES & LIST OF ALL CHARGES

Joining Fees: Nil

Annual Fees: Nil

Leave a Reply